As the attachment to traditional branches in banking continues to drop, a new method of network planning is required that revolves around building an enhanced customer experience.

It comes as no surprise that banking customers are continuing to migrate routine transactions and interactions to digital channels. At the same time, there has been a rapid shift in online shopping that has altered the marketing and sales funnels for banks and credit unions.

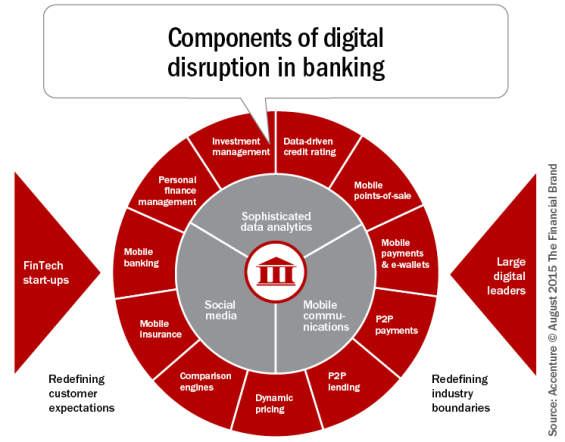

Technology as a core disruptor to the way we do banking. The disruptors in the banking industry are rewriting the rules followed for decades. But, these new rules will only suffice until the next wave of disruption comes along. As a result, banks and credit unions must be agile and responsive. Bold strategies will be required.

Instead of the traditional bell curve response of a typical product or service life cycle, a series of quick-fire innovations has produced a ‘shark fin’ business model, where disruptive products or services are embraced and discarded in fast succession.

As one of the world’s largest banks acknowledges: “we must change our execution model to be digital.”

- Taking on the organizational personality of a digital disruptor, targeting specific target markets or product lines.

- Building a digital wallet with in-app commerce built on value-added services.

- Providing integrated financial or non-financial solutions to serve life needs beyond banking.

- Leveraging crowdsourced lending and payment capabilities.

- Monetizing big data insights.

- Digital customer strategies – Consumers must be provided an omnichannel customer experience, where they can choose how to engage with their bank or credit union at any time on any device. The channels must be integrated and contextual, with the ability to proactively engage on behalf of the consumer.

- Digital enterprise strategies – The institution must evolve to become an overarching digital banking organization, including digitizes processes and procedures, digital collaboration tools and a digital culture.

- Digital operational strategies – Evolving to much more flexible technology that supports digital transformation is required. This includes an open architecture that will allow banking organizations to integrate with third parties that may have different architectures running differently.

The JPMorgan Chase veteran is the chief executive of the blockchain technology company Digital Asset Holdings. So you have to expect her to talk up the blockchain as she has, tout its potential to change the way the financial world operates, emphasize how it can reduce risk, improve efficiency and ultimately provide better customer service.

Among traditional bankers, some might agree there’s great potential in technology that facilitates an immutable record of transactional data.

Yet many remain skeptical about anything associated with bitcoin. Eyes glaze over at the details of how it works. Applications for the average bank seem to be distant still.

If this is how you think about the blockchain — that is, when you think about it at all — expect to be paying far closer attention soon. “The biggest idea in banking right now is blockchain technology,” says Brad Leimer, the head of innovation for Santander Bank.

Leimer is quick to say he’s not a bitcoin, blockchain or distributed ledger technology expert. But he considers the blockchain “big news” that banks of all sizes should care about. “It has fundamental properties capable of changing just about every financial transaction that people do today,” he says.

For more details visit: http://www.pwc.com

http://www.retailbankingconference.com/?gclid=CPf65a-HosoCFVEYHwody8QItg

https://accenture.com/us-en

Comments are closed.